BREAKING: The Senate just voted to confirm Howard Lutnick as Commerce Secretary.

— George (@BehizyTweets) February 18, 2025

Lutnick is one of the forces pushing President Trump to eliminate the income tax and fund the government using tariffs. DO IT, MR. SECRETARY!

My confidence in Lutnick is very high because Democrats… pic.twitter.com/tuATxFA0Sv

EXCLUSIVE: Commerce Secretary @howardlutnick says get ready — your tax rates, interest rates, and mortgage rates are going to come hammering down. pic.twitter.com/p2h6jzqU9h

— Jesse Watters (@JesseBWatters) February 20, 2025

? COMMERCE SEC. LUTNICK: "President Trump's goal is to ELIMINATE the Internal Revenue Service and let outsiders pay."

— Nick Sortor (@nicksortor) February 20, 2025

LFG! ABOLISH IRS! ?

"Imagine a Democrat Senator going against that? What planet are they on?" pic.twitter.com/iLWzPuh0hH

JUST IN: Woman has meltdown because Trump shut down her job where she studied "how to safely collect s*xual orientation and gender identity" practices.

— Collin Rugg (@CollinRugg) February 19, 2025

Lmao. You literally can't tell what's a parody anymore.

"I was told to stop work immediately and that no more research… pic.twitter.com/fdOBSHMEP2

JUST IN: Senate has confirmed Howard Lutnick as Commerce Secretary, 51 to 45.

— Collin Rugg (@CollinRugg) February 18, 2025

Lutnick lost over 650 friends, family members & employees in the attack on the World Trade Center on Sept 11, 2001.

This is one of the most powerful stories you'll ever hear.pic.twitter.com/qLvS79f5A4

Unpopular opinion.

I like Commerce Secretary Howard Lutnick.

“Commerce Secretary Howard Lutnick said Wednesday evening President Trump’s goal is to “abolish” the Internal Revenue Service (IRS).

The big picture: Lutnick’s remarks on Fox News, which come as the IRS is reportedly poised to lay off thousands of workers, build on a pledge Trump made to create an “External Revenue Service” to oversee tariffs and other potential foreign revenue.

Trump has also floated the idea of abolishing federal income taxes as part of his plans of “tariffing and taxing foreign nations to enrich our citizens.” …”

“The Internal Revenue Service will begin laying off roughly 6,000 employees on Thursday as part of the Trump administration’s push to downsize the federal work force, three people familiar with the agency’s plans said.

The terminations will target relatively recent hires at the I.R.S., which the Biden administration had attempted to revitalize with a surge of funding and new staff, the people said on condition of anonymity because they were not authorized to speak publicly.

The Trump administration has begun laying off probationary employees — who do not enjoy as much job protection as their more tenured colleagues — across the federal government in recent days. …”

Kyle Kulinksi will react to this by screaming about “fascism” a dozen times.

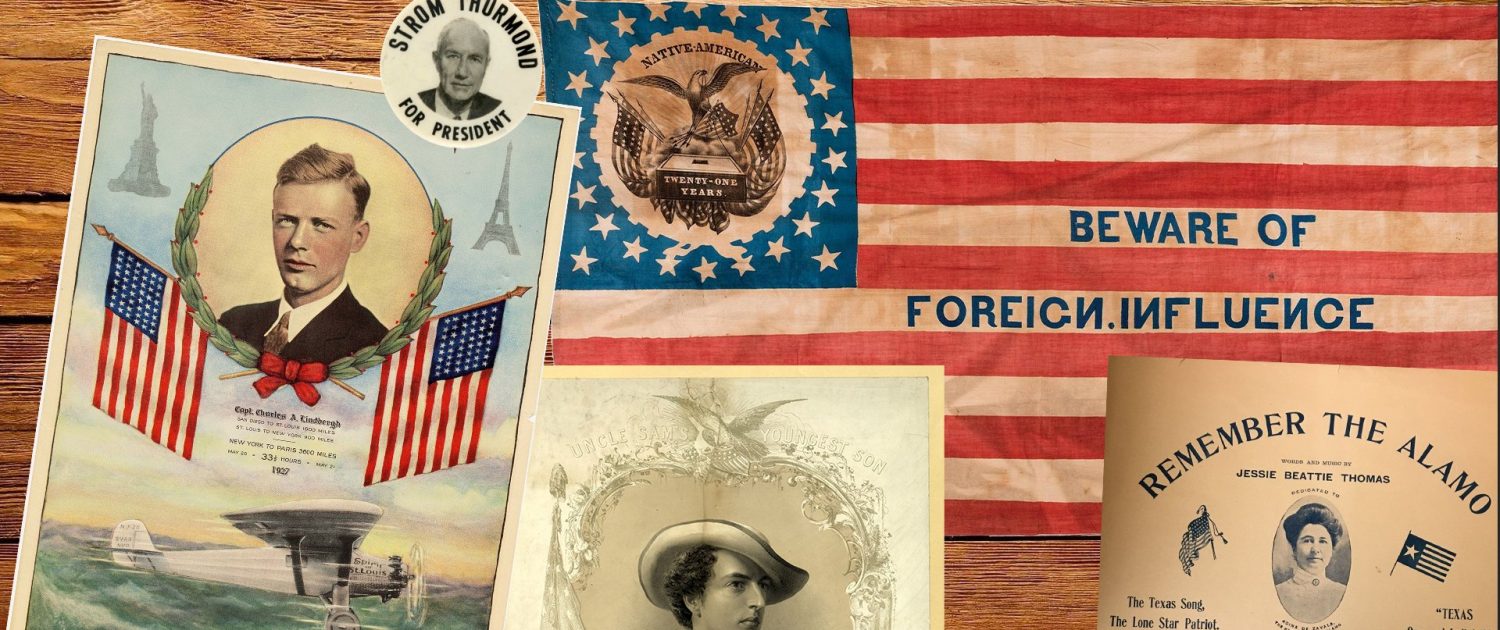

The following excerpt comes from Robert W. Merry’s book President McKinley: Architect of the American Century

“It was a burgeoning nation, full of zest and optimism, that bestowed the mantle of leadership upon William McKinley on that crisp March day. Not even the 1893 Panic, which still dampened commerce, could seriously erode the American sense of opportunity. The U.S. population had nearly doubled since 1870, to 75 million, with fully two-thirds of the increase coming from native births, the rest from immigration. The industrial era was generating an economic bustle in America that was recognized throughout the world as a rare phenomenon. When Democratic critics chided Republicans during the Harrison administration for fostering the nation’s first billion-dollar budget, Tom Reed dismissed the disparagement with characteristic disdain. “Yes,” he said, “but this is a billion dollar country.”

The billion-dollar country outpaced all others in steel production, in its timber harvest, in meatpacking, and in the mining of silver, gold, iron, and coal. The fervor of production was pushing America into the world in search of markets. In the thirty-six years leading to McKinley’s inauguration, exports tripled, and the country’s trade activity now surpassed that of all other nations save Great Britain. What’s more, America led the way in the development of life-transforming inventions, including the internal combustion engine, incandescent light, the telephone, steam-powered ocean vessels, moving pictures, radio telegraphy, the phonograph, and more.

America had been from its inception a nation of vast designs, driven by an impulse to consolidate its position across the North American midsection – purchasing the vast Louisiana expanse in 1805, negotiating possession of Florida in 1819, annexing Texas in 1845, acquiring much of Oregon Territory in 1846, and conquering lands in 1848 that would become its southwestern domain. “For nearly three centuries,” wrote historian Frederick Jackson Turner in 1893, the “dominant fact in American life has been expansion.” …

Whatever course America pursued, and whatever McKinley’s national plans might be, nothing took precedence over the need to attack what the Washington Post called the country’s “industrial distress and financial embarrassment.” No one was surprised that the new president’s central economic aim would be restoring the McKinley tariffs, which had averaged nearly 50 percent on finished and semifinished imports.

That had been shaved to 42 percent during the second Cleveland administration by the so-called Wilson-Gorman bill, and McKinley believed no economic resurgence could happen until his rates once again prevailed through adoption of something approaching the House-passed Dingley bill of 1895. Besides, the economic downturn had produced a federal budget deficit of 70 million dollars, which also required attention. McKinley’s answer was a big increase in import taxes.”

Lutnick is correct.

Liberals look at Gilded Age America as hopelessly backward and corrupt, but this was a country with no federal income tax, no schlerotic bureaucracy with countless thousands of worthless make work jobs for political hacks, a country where a $70 million dollar budget deficit was a huge problem, where we ran trade surpluses with other nations, where a budget surplus was viewed as a political problem, where we led the world in the innovations that made the 20th century possible. Today, we have a national debt of $36 TRILLION DOLLARS, which grows by about a trillion dollars every 100 days.

In order to fund our bloated government, we tax Americans at home while encouraging foreigners to export their products here tax free, which encourages corporations to relocate production abroad. We export prosperity abroad with a tax and trade policy subordinated to our foreign policy. What has mattered in Washington for decades is maintaining the so-called “rules-based international order.” Trump understands that the price of the liberal world order is allowing our “allies” to screw American workers. They defer to “American leadership” in exchange for security guarantees and access to our market.

The federal government was a fraction of its current size when it was funded by tariffs back in the Gilded Age. Besides that, the federal budget and deficit are much worse than the numbers indicate. Typically, the deficit is compared to the GDP. The US GDP is cooked to make it look much larger than it really is. The deficit compared to GDP is much larger as a percentage than it would appear to be.

The Gilded Age was a time when the South and the rural Midwest paid a disproportionate amount of taxes, because the tariff is a very regressive tax.

Introducing the income tax to shift some of the burden onto rich New Yorkers, and thus provide some tax relief for the rest of the country, was a wise decision.

As long as the income tax only affected the very wealthy, there was no problem. FDR turned income taxes into a curse when he introduced regressive income taxes, first the social security tax and then federal income taxes for all income brackets to finance WW2.

Tariffs have a proven track record of encouraging industrialization, but they are certainly not an unmixed blessing. There is are very clear downsides – they are a regressive tax, and they invite retaliatory tariffs which are bad for globally competitive sectors of the economy which don’t need protection.

Ideally, the proceeds of protective tariffs should be distributed to the people as UBI. They should not be used as a source of net revenue for the government.

Wealth taxes and vice taxes should finance the government. In other words, Howard Lutnick and his friends should continue to pay their fair share if they want to keep living in this country.

I am not in favor of this. Only 20% of the budget is non-defense discretionary, including lots of stuff people like which individually doesn’t cost much, like NASA, national parks, and highway funds – so maybe you can cut 20-25% of this or 4-5% of overall spending ($300-$400bn). Good luck earning $7,800bn from tariffs to fund the rest of the gov. Defunding the IRS is retarded, nobody likes paying but if taxes are in the law then they should be collected and enforced, anything else means honest citizens are subsidizing tax cheats.

The biggest risk for us in the coming years is that Trump dissipates energy & enthusiasm on nonsense like buying Greenland or DOGE dividends while failing to complete the obliteration of Left-Wing Activism Inc or the affirmative-action “disparate impact” state.

As the Federal leviathan is rolled back to the very much reduced form it took during the Gilded Age, I hope the Constitution will similarly be restored to its leaner form. Repealing the Sixteen Amendment is a no-brainer now and would be a legacy Trump could be proud of. Is the repeal of all subsequent amendments too much to hope for?

At least some of the soon-to-be-unemployed IRS agents learned some useful marksmanship skills thanks to Biden.

Kyle lives in an ideologically blinkered world. This isn’t fascism. Its obviously Libertarianism. I feel cheated. I was voting for a Republican not a Libertarian party platform.

Today I learned Trump has surrendered ICEing the country out of the illegal foreign settler occupation. He has decided instead to give me a pathetically small paycheck for selling out the country along with smiley faced note:

“We tried, but you can go buy some cheetos for free courtesy of DOGE.”

DOGE could obliterate the entire federal budget and if it gave 20% of the savings to every person in the US as Trump has promised we’d get a single check for $3,000.

It’s clear that after about 30 days of trying, Trump has gotten bored with expelling illegal foreign occupiers and decided to obliterated the IRS. So your $3,000 check is a one time thing too.

“In order to fund our bloated government, we tax Americans at home while encouraging foreigners to export their products here tax free, which encourages corporations to relocate production abroad.”

We don’t fund the bloated budget by encouraging foreigners to export their products here tax free. Thats the problem. That guts the government’s revenue, impoverishes our services, and above all impoverishes the common man.

The foreigners who get to sell their products for free and the tax on Americans are separate issues. You can tackle the foreign interest problem without obliterating taxes and vice versa. Getting rid of taxes won’t get rid of foreign interests.

“We export prosperity abroad with a tax and trade policy subordinated to our foreign policy.”

The tax and trade policy isn’t subordinated to our foreign policy, because its not OUR foreign policy. Its a foreign policy captured by foreign interests. The tax and trade policies are subordinate foreign interests.

Ergo, obliterating all taxes or any trade policy isn’t going to change the fact the country is captured by foreign interests. We elected Trump to eliminate foreign interests not eliminate the US government.

Sasly, this is rhyming with the arc Trump did last time. In Trump 1.0 who made a big deal about illegals and then gave tax cuts to the worst people. Now, in Trump 2.0 he is going to deregulated oversight of the worst people.

Returning to the Gilded Age were ideas many conservatives in GenX dreamed of when they were in High School. Learning about the Gilded Age disabused ourselves of that nation.

The Gilded Age gave us political racketeering, city bosses, mafias and organized crime, rats in our industrial beef, contaminated bread, and millions of Ellis Island Rif Raf who irredeemably retarded and coursened American culture. It was a time when Big Business corporations and a few Oligarchs self aggrandized vaste amounts of wealth to themselves and virtually replaced government law and order with corporate law and order. The early progressive age which gave us regulations, the IRS, etc was an attempt to tame these corporations and oligarchs. Getting rid of the IRS will effect about 40% of the population who pays income taxes. No one else pays income taxes.

Hunter, you don’t want to live in the Gilded Age, where Mexican Cartels run your fishing hole on behalf of Tech Bros, whove sucked out the water to cool the AI factory that was built on the little forest nearby, which is run by Hindu Dots and Sand N@ggers who stink up your town with curry and blast minaret singing Imam prayers four times a day. But hey, you’ll get your $3,000 check to buy some contaminated cheetos and rat meat. That’s for the people who paid income taxes. Everyone else gets nothing.

Also,

“Unpopular opinion.

“I like Commerce Secretary Howard Lutnick.”

I do too. He sounds like your typical stereotype of hard bitten Big Jew. But, he actually is very kind and thoughtful. Tough, but fair. It is true he hired a bunch of friends and family and superb employees and pulled back from work after giving them alot of money. What they don’t say is he planned to retire by the time he was 40 or 45 long before.

He was a good planner and ended up with way more money than he planned. Except for one plan. Weirdly, he picked WTC to house his firm. He was told it was a major terror target and brushed it aside. Not till later, just prior to 911, when was he approached again and explained the major threat, did he belatedly realize the problem.

But for his help in coordinating with us for additional safety and security measures, the losses at WTC would’ve been even worse. As it was even those protocols weren’t possible to save his friends and family. He is a lucky guy. He’s got to live with the luck but not with his brother and friends. Lutwick will be a good Secretary. But, we still got to impress upon him the serious danger the country faces. He still underestimates danger.