By Hunter Wallace

Ha-Joon Chang’s Kicking Away The Ladder: Development Strategy In Historical Perspective is a blistering critique of what is known as the “Washington Consensus.”

According to the “Washington Consensus,” there are a number of “good policies” which developing countries need to follow to achieve economic growth – things like trade liberalization, privatization of state-owned enterprises, deregulation, liberalization of foreign investment, etc. Chang argues that developed countries are guilty of “kicking away the ladder” by using global institutions like the IMF, World Bank, and WTO to deny developing countries the ability to use the policies that they used to ascend to the top of the world economic order.

Starting with Britain and the United States, which have been the world’s leading champions of free-trade and neo-liberal economics, Chang shows how both countries used ITT policies (industrial, trade, technology policies) to reach the apex of economic development in 1860 and 1945 respectively. He also analyzes the economic development of France, Germany, Sweden, Belgium, Switzerland, the Netherlands, Japan, and the East Asian Tigers (South Korea, Taiwan, Malaysia, Singapore) to show how they all used similar “catch-up” policies.

Chang’s careful study of “how the rich countries became rich” leads him to the conclusion that economic development is ultimately about the mastery of foreign technologies and ascending the international food chain in high-value manufacturing. Small countries which are close to the technological frontier – Belgium, the Netherlands, and Switzerland – have been more laissez-faire. Larger countries which have needed to “catch-up” with their industrial rivals – the United States, France, Japan – have been more interventionist.

Chang is careful to distinguish between policies and institutions. The tariff, for example, is an institution, while trade policy can be tuned as easily as a radio to changing conditions. He is adamant that the tariff is not the only or even necessarily the most important policy tool that has been used to nurture infant industries:

“There were many other tools, such as export subsidies, tariff rebates on inputs used for exports, conferring of monopoly rights, cartel arrangements, directed credits, investment planning, manpower planning, R&D supports and the promotion of institutions that allow public-private cooperation.”

There’s also currency manipulation, government procurement contracts, state-owned enterprises, direct subsidies, regulations, infrastructure spending, and education spending by which the state intervenes in the economy. In particular, Japan has been an innovator in developing a wide array of policy tools beyond the traditional tariff.

A close historical examination of major institutions in the developed countries – liberal democracy, modern bureaucracies, modern judiciaries, intellectual property rights (trademark, copyrights, patents), corporate governance institutions (bankruptcy, competition, limited liability), central banking, securities regulation, the welfare state (health insurance, unemployment insurance), and labor laws – shows that these institutions are the result rather than the cause of economic development.

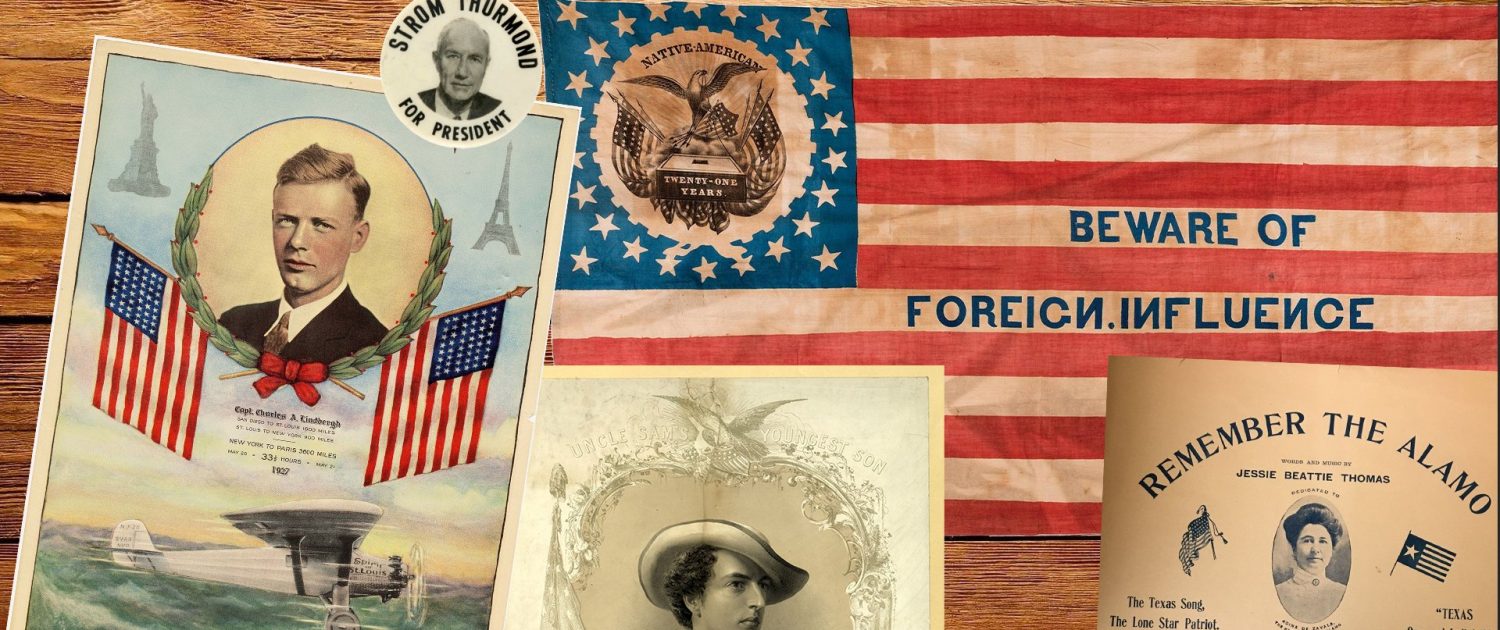

Consider the case of Western liberal democracy. In the developed countries, universal suffrage including women and minorities was achieved in the US (1965), the UK (1928), Switzerland (1971), Sweden (1918), Australia (1962), Austria (1912), Belgium (1948), Canada (1970), Denmark (1915), Finland (1944), France (1946), Germany (1946), Italy (1946), Japan (1952), Netherlands (1919), New Zealand (1907), Norway (1913), Portugal (1970), and Spain (1977).

The UK became the world’s richest, most industrialized nation without liberal democracy, child labor laws, or securities regulation. Similarly, the US succeeded the UK while denying blacks the right to vote in the Southern states and without a national healthcare system. Did you know that Canada denied patents to pharmaceutical products until the 1990s or that the American chemicals industry was built using stolen German patents after World War I? Surely, you know that Soviets used industrial espionage to acquire the atomic bomb.

Chang’s disturbing conclusion is that when countries reach the technological frontier and become wealthy and developed – like the UK in 1860, or the US in 1945 – they export the “free-trade” doctrine in order to “pull away” from their rivals. During the first liberal world order, the UK did this by colonization and imposing unequal treaties on countries such as China, Persia and the Ottoman Empire. In the second liberal world order, the US does this through the IMF, World Bank, and WTO.

While I can see how foreign competition from advanced industrialized nations strangles infant industries in the Third World, I am not sure that I completely buy into Chang’s conclusion. The US, for example, has switched to free-trade for largely geopolitical reasons. In order to maintain the US Empire and win the Cold War, America sacrificed its economic self interest and allowed foreign competitors to destroy many of its own industries. It was good Cold War politics to trade with Japan, West Germany, and Italy to bind those countries to the American led world order, but it wasn’t good economics. Similarly, Britain’s embrace of free-trade may have “kicked away the ladder” for Ireland, India, and China, but was that true of the United States and Germany which eventually eclipsed Britain in industrial power?

There are plenty of countries climbing up the ladder of economic development behind the United States. If history is our guide, the US itself will be forced to abandon free-trade at some point as the second liberal international order begins to collapse.

“… maintain the US Empire and win the Cold War …” Beginning with the Spanish-American and the U.S. overseas military/economic empire, there has been gradually increasing pressure toward open borders and mandated racial equality. With isolationism and economic self-sufficiency, the U.S.A. could ignore the attitudes of non-Whites outside the U.S.A. But with Cold War wooing of non-Whites and the rise of international corporations, globalism eroded and now threatens to destroy Whites in the U.S.A. (and in the White puppet countries of the U.S. empire).

http://www.oldmagazinearticles.com/Cold-War-editorial-1954#.VmjMlenFsfE 1965 Immigration Law Benefited the Cold War

one version of “free trade” is simply the top-dog’s version of mercantilism i.e. the top dog tries to prevent mercantilism by their competitors so the top dog has free and dominant access to all markets.

it is self-interested with altruistic propaganda

the second version – or maybe people simply come to believe the propaganda – is the “come take our economy” one.

Good stuff. You’re cooking with gas on this theme.

I agree with you that the “average” US citizen lost to free trade and that some of this was due to geopolitical concerns via the Soviet Union but not all people.

Why did Great Britain move to free trade even when the USA was kicking their ass in trade? The reason is the collapse of profits in manufacturing. The beginning of the Industrial Revolution bought some of the most stupendous profits ever. Steam engines were doing the the work of a 100 horses (100HP) for little or nothing compared to an actual horse or a Man. Eventually competition narrowed the profits. At that point the financiers and the “powers that be” made more money financing other countries industrialization than they did manufacturing themselves.

I admire the structure the Japanese built to benefit their people a great deal. They would do things like sell land to companies super cheap. The companies would in turn sell these for profits and use the capital. The used cartels to buy resources. Having one big buyer to decrease the competition for buyers for whatever resource they wanted. They had loose controls on certain types of saving in the postal system and in turn giving this capital to companies cheaply. They used a million little aids to their industry to become a massive powerhouse. Most people don’t know it but a LARGE amount of stuff from China is actually Japanese. What they did is to make very high tech sub-assemblies and parts that the Chinese needed. They package them and say “Made in China” but the main profitable value added portion come from Japan. Other things they sell are a lot of the metal dies to make metal parts, shoe patterns, etc. Even the tools to make the tools are made in Japan.

They’ve even been able to keep the companies directors on a short leash. They make much less than American CEO’s and are not likely to sell off technology for short term profits that destroy the company over time but put fast cash in the CEO’s pockets. I think one of the ways they do this is cultural and the other financial. Culturally the Japanese CEO’s get great respect. That’s what it’s all about anyways, right? Verblen, “Status” and all that. In the US there’s just no status in running a big company unless you’re making a shit pot full of money. Financially any Japanese CEO that sold off the family jewels tech would soon find he couldn’t get loans and would be out on the streets. It’s just not done.

There’s only one problem with Mercantilism. If everyone is practicing it everyone is poorer. Don’t be mistaken that I’m not for it for the US because I don’t want to be the sucker. We’re worse off because we sell off all our tech and bugger our trade.

I do believe that large stuff like water, sewage, power, infrastructure should be publicly owned. The capitalist are always screaming that’s it’s inefficient. Maybe it is a little less efficient but if it’s not public you have to skim off 20-30% to the financial types before you get any service. You could have a hell of a lot of inefficiency at those prices. Also public services tend to be much more forward looking and invest more infrastructure as infrastructure is a sort of “profit” that the bureaucrats count as being profitable in a no profit system. California once had some of the best electrical power systems in the nation. They sold those off and went to having power shortages.

We need to crush financialization of assets. Derivatives and other financial quick profit centers need to be heavily taxed. Investments covering buildings, infrastructure, businesses and productive assets need to be given hefty tax breaks. Tax breaks for ANY building, employees, etc, outside the US would receive no tax breaks at all unless they were for resources that were impossible to get in the US. I’m talking minerals and such and we should pursue substitution of any minerals that we can’t produce if at all possible.