Huey Long best clips 4/13 pic.twitter.com/4c3JpylAdv

— Queenfish Sadie Long (@MrsHueyLong) January 19, 2021

HAPPENING NOW: Reagan cuck gets destroyed by the Kingfish Gang https://t.co/KybntDWxbF pic.twitter.com/JIEG1fSLtb

— Queenfish Sadie Long (@MrsHueyLong) January 26, 2021

It’s time for a wealth tax in America.

— Elizabeth Warren (@ewarren) February 3, 2021

Here’s how it works: pic.twitter.com/kK6zNRjKn3

Consider two people:

— Elizabeth Warren (@ewarren) February 3, 2021

– An heir with $500 million worth of yachts and jewelry and art

– A public school teacher with no savings in the bank

They both bring home $50,000/year. And they both pay the same amount in federal taxes.

That’s a system that is rigged for the top.

My plan: Just a two-cent #WealthTax for every dollar over $50 million in assets and a few more cents for every dollar of wealth over $1 billion. With that, with the wealthy starting to pay their fair share, we can help working families recover and help improve their lives.

— Elizabeth Warren (@ewarren) February 3, 2021

Elizabeth Warren has embraced a watered down wealth tax.

I’ve just now realized this because it never occurred to me to vote for Elizabeth Warren. She is too toxic on cultural issues to attract populist voters which is why it is safe for her to run on a wealth tax as a performance art issue. A wealth tax is far more popular than Elizabeth Warren.

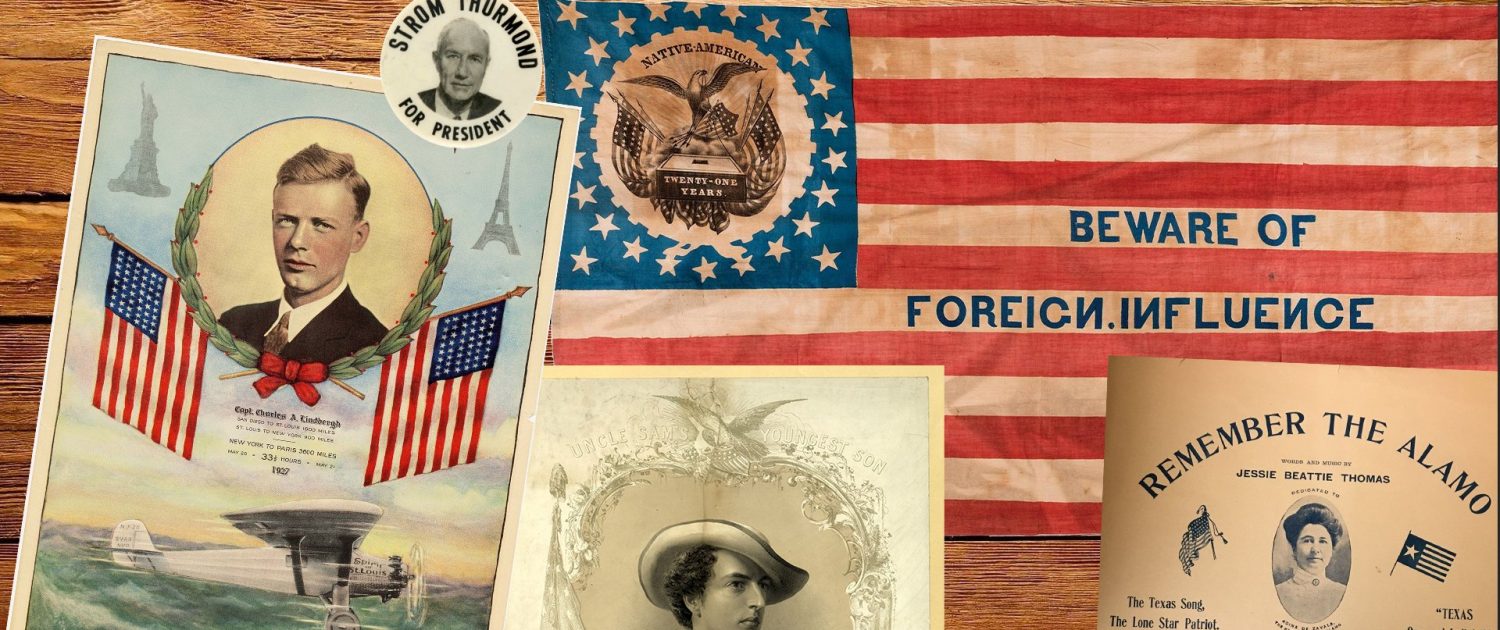

We’ve spent the last month educating the public on the history of American populism, Huey Long and the unrealized goals of his Share Our Wealth program and how middle class progressives have a long history of stealing the ideas and cloaking themselves in the language of populism to advance their own culture war agenda. Father Coughlin’s magazine, for example, was Social Justice and progressives have mangled the original meaning of the term beyond recognition and turned it into political poison.

“Social Justice” now effectively means authoritarian wokeness instead of a more equitable distribution of wealth or a living wage for the working class and middle class. It brings to mind Twitter lynch mobs and violent Antifa groups. Huey Long and Father Coughlin were the OG Social Justice Warriors.

“For decades, the wealthy and the well-connected have put American government to work for their own narrow interests. As a result, a small group of families has taken a massive amount of the wealth American workers have produced, while America’s middle class has been hollowed out.

The result is an extreme concentration of wealth not seen in any other leading economy. The 400 richest Americans currently own more wealth than all Black households and a quarter of Latino households combined. According to an analysis from economists Emmanuel Saez and Gabriel Zucman from the University of California-Berkeley, the richest top 0.1% has seen its share of American wealth nearly triple from 7% to 20% between the late 1970s and 2016, while the bottom 90% has seen its share of wealth decline from 35% to 25% in that same period. Put another way, the richest 130,000 families in America now hold nearly as much wealth as the bottom 117 million families combined. …

That’s why we need a tax on wealth. The Ultra-Millionaire Tax taxes the wealth of the richest Americans. It applies only to households with a net worth of $50 million or more—roughly the wealthiest 75,000 households, or the top 0.1%. Households would pay an annual 2% tax on every dollar of net worth above $50 million and a 6% tax on every dollar of net worth above $1 billion. Because wealth is so concentrated, this small tax on roughly 75,000 households will bring in $3.75 trillion in revenue over a ten-year period. …”

This is considered “radical” after fifty years of neoliberalism.

It is modest compared to what Huey Long was proposing in the 1930s. If Long had gotten his way on Universal Basic Income (the floor of capitalism) and Universal Maximum Income (the ceiling of capitalism) in the Great Depression, there wouldn’t be a single billionaire left standing in the United States. Among other things, President Huey Long would have never plunged America into World War II.

“Since Democratic presidential hopeful Sen. Elizabeth Warren (D-MA) proposed “The Ultra-Millionaires Tax” in January 2019,[1] the idea of a wealth tax to combat income and wealth inequality has been near the forefront of the policy debate. Both Sen. Warren and fellow presidential candidate Sen. Bernie Sanders (I-VT) have released proposals to tax wealth as part of their 2020 platforms.

Sen. Warren’s original proposal would tax household net wealth above $50 million at a 2 percent rate per year and above $1 billion at a 3 percent rate. Sen. Warren boosted the size of the billionaire’s wealth surcharge to 6 percent from 3 percent when she released her plan to pay for Medicare for All.[2]

In September 2019, Sen. Sanders proposed his version of a wealth tax plan: a 1 percent tax on wealth above $32 million for married couples ($16 million for singles) that increases to 8 percent for wealthier households. Net worth for joint filers between $50 million to $250 million would be taxed at 2 percent, $250 to $500 million at 3 percent, $500 million to $1 billion at 4 percent, $1 billion to $2.5 billion at 5 percent, $2.5 billion to $5 billion at 6 percent, $5 billion to $10 billion at 7 percent, and 8 percent on net wealth over $10 billion.[3] …

Seemingly low 2 percent and 3 percent wealth tax rates imply much higher income tax rates; in this example, 40 percent and 60 percent, respectively. For safe investments like bonds or bank deposits, a wealth tax of 2 or 3 percent may confiscate all interest earnings, leaving no increase in savings over time. A wealth tax of 6 or 8 percent will certainly reduce wealth accumulation for such low-risk and low-return investment. Asset owners with 6 or 8 percent return on higher-risk investments, such as private equity funds or corporate stocks, may still be able to accumulate wealth. However, they still face capital gains and dividend taxes, state and local income taxes, property taxes, and other taxes. …”

Anyway, it is a start.

There needs to be some kind of wealth tax on the top 0.1% that creates a ceiling on wealth in the $50 million to $100 million range. The oligarchy needs to be given an enema. Currently, they have the wealth and power to rule over us mere mortals like Saudi princes. Now that I think about it, the Gulf Arabs have demographically replaced their own population in places like Bahrain and Qatar.

FEE:

“In fact, wealth taxes have failed across the world where they’ve been tried.

“Warren’s proposal has a dismal track record in other countries that have attempted wealth taxation,” Senior Research Fellow at the American Institute for Economic Research and economic historian Phil Magness warned. “It simply encourages the wealthy to relocate abroad, taking their businesses with them.” …”

Brad Polumbo and Tucklypuff are against the idea.

Crushing the oligarchy and the massive political corruption this maldistribution of wealth generates is the primary reason why I support a wealth cap. Let them relocate to Israel. That’s still a win.

Just a very gentle reminder:

(((LEO FRANK)))

“We’ve spent the last month educating the public…” WE? Who’s WE, White Man?

HW, you are way too self-important in your own estimation, for someone under 40 with only a Bachelor’s degree.

The diffence between other countries and the USA is that the USA is a global military empire. Capital flight would be almost impossible from the USA if politicians wanted to control it.

“it is safe for her to run on a wealth tax as a performance art”:

These sickening performances must be absolutely ignored, not encouraged by attention. Mainstream media including Murdoch’s Faux News, including the star Tucker Carlson, must not receive any views. The presstitute “news” journalists must be absolutely starved of attention.

Even if populist temporary reform really was possible, it would not change the nature and ultimate trajectory of the plutocratic system.

1. Uncap Social Security

2. Cut taxes on wages, raise taxes on capital gains

3. Guillotines. “Kill one, terrify one thousand.” — Sun Tzu

OT, slightly

HW, I’m sure you saw this on CCW today, a preacher that worked closely with Huey Long et al.

https://counter-currents.com/2021/02/gerald-lk-smith/

Dear Gentle Lotus Eaters of the Dissident Right

Filthy Fucking Cockroach (((LEO FRANK)))

The slaughter of the Native Born Working Class White Christian mostly teenager crew of the USS LIBERTY back in 1967…..WHO ORDERED THIS?……While LBJ had his cock sucked by Matilda Krim in the Oval Office……

The Passage of the 1965 Immigration Reform Act…two years before the slaughter of the crew of the USS Liberty….

(((THE ADL)))

The well-known PBS establishment historian Doris Kearns Goodwin also had the sexy-time with LBJ while she was a White House intern in the 1960s. Where the hell was Ladybird when her husband was engaging in these shenanigans?

She was getting taken care of by Ted Kennedy, he wasn’t very picky, just ask Mary Jo Kopechne.

“Let them relocate to Israel. That’s still a win”:

Definitely NOT A WIN for the indigenous people of Palestine, who nearly everyone conveniently forgets about. Everyone forgets how beautiful, prosperous, peaceful and secular Palestine was before Nakba: https://www.youtube.com/watch?v=sT22bwJ55Sw – just as we also forget how beautiful, modern and secular Afghanistan was before the U.S. overthrew it using proxy forces (Mujahideen) and began a military occupation that continues to this day: https://www.youtube.com/watch?v=c1C1lpiB3f8

Afghanistan has never been beautiful or modern. It’s a s***hole country populated by abusive pedophile homosexual males. The Mujahadeen were built up to take on the Soviets.

Correct: “The Mujahadeen were built” (by the U.S./CIA)

Incorrect: “Afghanistan has never been beautiful or modern”:

U.S. Imperial strategy launched in 1979 to destroy Afghan socialism:

“Definitely NOT A WIN for the indigenous people of Palestine, who nearly everyone conveniently forgets about.”

So, Anonymous… Are you saying that we need a “Final Solution” for the Christ-killers?

I’m all for that!

I believe a new populist movement also needs to be an anti war movement. And be consistent against endless low grade wars and occupations that go on for decades.

BRING THE TROOPS HOME NOW!!!

OR

Nuclear WW3 occurs within a year……

It makes much more sense to be obsessed with BRINGING THE TROOPS HOME NOW!!!! then sniffing and counting the number of bacteria in the jockstrap of multimillionaire War Hawk-Chicken Hawk Jock Tom Brady….Don’t you think so?

I dunno, I’m starting to like the idea of a global nuclear war, especially if Washingcoon and the Zionist state in Palestine get incinerated.

Wouldn’t raising the capital gains tax, at least it’s rate on income over say “X” level dollars be a simpler way to start this? Her example of a boat and some paintings are questionable, neither generate any cash and sit there, the boat being a big liability and expense to take care of. Would you have to take out a reverse mortgage on a painting to pay it down? Would the value of this kind of stuff crash because nobody would want $100 Monets when you had to take out a reverse mortgage on them?

Don’t most ultra wealthy actually generate a huge amount of continuing income on their assets that in fact could be simpler to target by raising rates much higher on these incomes over several million dollars? I know they talk about Joe’s plumbing business looking like an ultra wealthy person on paper before he pays his employees, supplies, and overhead. But aren’t people like this supposed to form LLC’s and then pay personal income tax only on what is leftover for his own profit? Her proposal sounds like it would be as complicated as Obamacare, a lawyer’s dream.

I hate to say it but AOC’s idea of 70% rates for these really high multi-million billion type dollar income’s seems simpler. But seriously, when I hear these people say we can’t have national health care, that assumes these Reagan-Bush-Paul Ryan tax cuts for the ultra rich are the status quo. I say raise it, Michael Savage was right when he said “the big lie is these people and companies are going to use these tax cuts to invest in America, they’re not, they’re going to use that money and invest it in China!”